If You’re Married Filing Separately, You Meet the Conditions Again, the deadline for filing 2022 tax returns is April 18, 2023. You must have a Social Security number that you obtained before your tax return’s due date.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

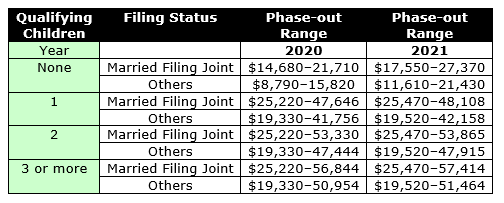

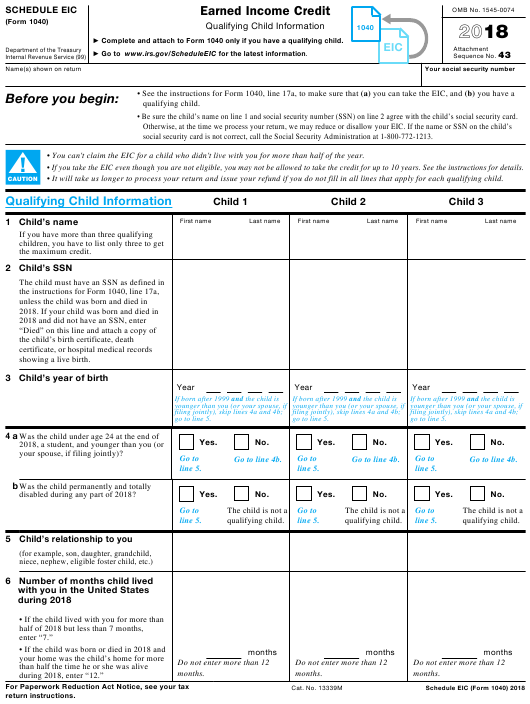

$53,057 for those with three or more children or dependentsĢ.$49,399 for those with two children or dependents.$43,492 for those with one child or dependent.$16,480 for those with no qualifying children or dependents.$59,187 for those with three or more children or dependentsįor those filing as single, head of household, or widowed, the following AGI limits apply:.$55,229 for those with two children or dependents.$49,622 for those with one child or dependent.$22,610 for those with no children or dependents.What counts is your 2022 adjusted gross income (AGI): your total pretax income minus certain deductions.įor those married filing jointly, the following AGI limits apply: Your Income Must Be Below a Certain Threshold 7 Rules Taxpayers Must Fulfill To Qualify for the EITC 1. If you meet the requirements, there are additional criteria you must fulfill, depending on whether you have kids. And you must have been at least 25 years old but under age 65 as of December 31, 2022.Īll taxpayers must pass the IRS’ seven-rules test as well. The IRS also requires that no one else can claim you as a dependent on their tax return. To claim the EITC, you must work in the U.S., and your main home must be in the U.S. Who Qualifies for the Earned Income Tax Credit? If the amount of your earned income credit is more than what you owe, you’ll be refunded the difference.

The EITC is a tax credit that will lessen your tax liability if you owe money.

How Does the Earned Income Tax Credit Work? Income that does not qualify for the credit includes interest and dividends, pensions or annuities, Social Security, unemployment benefits, alimony and child support. Examples of earned income include wages, tip income and net self-employment income. Generally, you won’t qualify for the credit if you don’t have earned income. The EITC is based on a percentage of your earned income. The EITC is a refundable tax credit, meaning it can reduce your tax bill and possibly generate a refund-even if you don’t owe any taxes. On Jackson Hewitt's Website What Is the Earned Income Tax Credit?

2021 EIC TABLE HOW TO

Here’s how to learn if you’re eligible to take the credit on your 2022 tax return, due April 18, 2023. The IRS estimates that 20% of taxpayers who qualify for the EITC never claim it. The credit for childless workers and couples was temporarily beefed up for the previous tax year under the American Rescue Plan, President Joe Biden’s pandemic relief law.

If you don’t have eligible dependents, you can get a maximum credit of $560-a sizable step down from $1,502 on 2021 tax returns. For 2022 returns, the maximum credit for filers with three or more qualifying children is $6,935, up from $6,728 in 2021. For tax year 2022-meaning the return you file in 2023-you may qualify for the credit if your income is less than about $59,200.Įligible workers with dependents may see a boost in their EITC this tax season. The EITC has evolved and now helps taxpayers with or without children. The earned income tax credit was first enacted in 1975 to provide financial assistance to working families with children. Your new submission deadline is October 16, 2023. If you submitted Form 4868 for a 2022 tax filing extension before April 18,

0 kommentar(er)

0 kommentar(er)